Investing in Autographs: 6 Things You Need to Consider March 15 2024

Investing in autographs is a compelling niche in the world of collectibles, combining the allure of personal connection with historical figures and celebrities with the potential for substantial financial gain.

Every collector wants to also think his autographs are a good investment, but the truth is that is not always the case - and sometimes, by far.

Navigating the market requires a high degree of blend of passion, knowledge, and strategic acumen.

SIX IMPORTANT TIPS

In this article, we provide six important tips that every collector and investor should understand before venturing into this unique investment avenue.

1) Know your deal really well. Just like with all types of investing, you need to know your field very well, and avoid gambling. Investing in autographs is not an exemption: it requires a high degree of knowledge of your field in order to make good educated choices.

[CLICKABLE IMAGE] A gorgeous black-and-white photograph of Frank Sinatra in his youth, signed and inscribed by him.

Avoid making guesses and make sure you already know the market for a particular autograph, looking at historical prices, what is currently available and for how much it is being offered. Speak with sellers, rather than buyers, about the demand of your particular interest and how it has been growing in the last few years.

2) Rarity is important. But rarity alone is definitely not enough, you need to be aware of how much demand there is for the rare item. Once again, talk to dealers and other collectors who are collecting what you want to invest in.

3) Focus on bigger value and in market fluidity. Pieces that are both rare and desirable, of higher value are a better choice if they are also from areas that are popular. Remember that sports, music and film & entertainment are by far the 3 most popular fields in autograph collecting, and are a much safer bet. Early Americana and presidential autographs are also quite popular in the United States market. Autographs from popular categories are a lot easier to find buyers for and to move, if needed.

4) Decide what to focus on. It is very important you understand that when you are focused on collecting, you are not going to be much effective on the investing side of autographs, and vice versa. Is it for fun or for business?. It is extremely difficult to do both well at the same time. If you keep this in mind from the beginning, then choose a path - financial or collecting for pleasure - and follow it. Ask yourself if you are buying a piece for one or the other.

[CLICKABLE IMAGE] A gorgeous autograph music quote of Aida written and signed by its composer Giuseppe Verdi in 1881.

5) Long term works best. As a general rule, it is the long term that works best in autograph investing. Autographs of recently deceased celebrities do increase in price right away, but not by much, they tend to increase more in value over a longer time.

6) Inquire about authentication before you purchase the service. In some cases a Certificate of Authenticity will make easier the selling of your investment, and it can increase the value you obtain for your item. So it can be a good investment, but not necessarily always is. Sometimes the cost of a certificate of authenticity by a certain authenticator/s can be very high and will not be worth it. We strongly recommend you ask auction houses, dealers and collectors. Shop around for prices of authentication certificates and the waiting times involved to get them, do it so with more than one company that offers that service, and then make a decision when you have all the elements.

Authentication stickers or certificates tend to be a smarter decision if you are going to buy and hold something for the long run, and for more valuable pieces, but they are usually not needed if you already have something that you found or received, and you want to sell it right away.

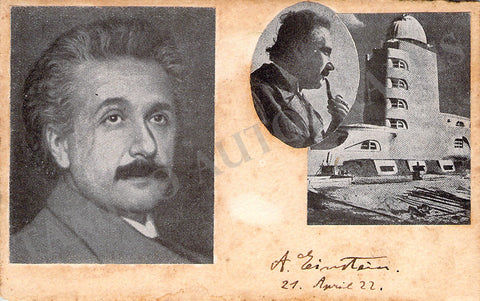

[CLICKABLE IMAGE] An interesting card attached with three half-tone photographs of Albert Einstein and signed by him, dated April 21, 1922.

In other words, authentication certificates could be a good choice depending on several factors, but they could also be something that can get in your way if they are expensive and take a very long time to be obtained.

IN SUMMARY

Navigating the autograph collecting and investing world requires a thoughtful and educated approach. By setting clear goals, focusing on long-term investments, and ensuring the authenticity of your acquisitions - with or without certifications - you can invest in autographs and potentially see substantial returns.

Remember, patience and diligence are your greatest allies in this venture. Whether you're collecting for pleasure or as an investment, the joy and satisfaction derived from owning a piece of history are unmatched. Take the first step today, and begin your journey into the world of autograph investing.

RELATED BLOG ARTICLES:

- Autograph Dealers: Fake vs Real - 12 Things to Consider

- Where to Get Autographs Authenticated

- Where to Sell Autographs: Things to Keep an Eye On

- Autograph Collecting 101: A Beginner’s Guide

- Where to Buy Authentic Autographs

- 7 Things to Do for An Autograph Session

- How to Avoid Buying from Fake Sites

- Collecting Music Autographs: An Appealing Hobby

Interested in authentic autographs?